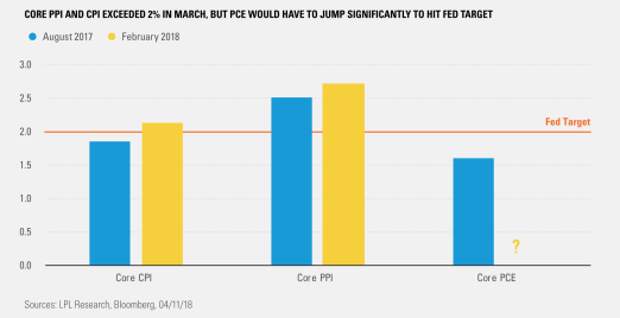

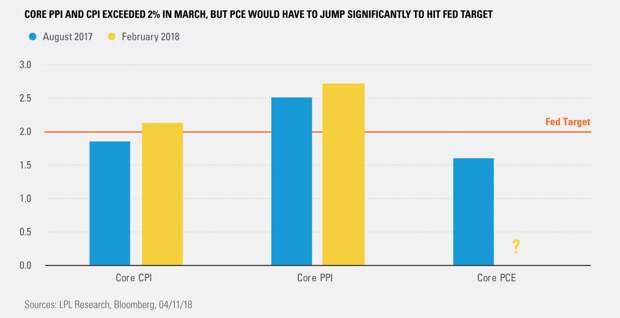

The recently released March readings for the Consumer Price Index (CPI) and Producer Price Index (PPI) both moved higher. Headline CPI, which measures the prices that consumers pay for a variety of goods and services, hit 2.4%, while the core reading, which removes the impact of food and energy prices, came in at 2.

1%. On the other hand, the PPI, which measures the wholesale selling prices received by producers*, accelerated at 3.0% and 2.7% for headline and core readings, respectively. In fact, the core reading was the highest since February 2017 for CPI and October 2011 for PPI.But what does two major measures of inflation rising above the Federal Reserve’s (Fed) 2% target mean for the future path of rate hikes? As our chart of the day suggests, it doesn’t mean a lot in the near term. Chief Investment Strategist John Lynch explains, “Both CPI and PPI ticked higher in March, but the moves were moderate and do not reflect a major increase in inflation pressure. We would likely need to see a significant move higher for PCE inflation (currently at 1.6% year over year), or wage inflation nearing 4% before we would expect a more aggressive Fed.”

IMPORTANT DISCLOSURES

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

The Producer Price Index (PPI) program measures the average change over time in the selling prices received by domestic producers for their output. The prices included in the PPI are from the first commercial transaction for many products and some services.

Personal consumption expenditures (PCE) is a measure of price changes in consumer goods and services. Personal consumption expenditures consist of the actual and imputed expenditures of households; the measure includes data pertaining to durables, nondurables, and services. It is essentially a measure of goods and services targeted toward individuals and consumed by individuals.

* Sellers’ and purchasers’ prices may differ due to government subsidies, sales and excise taxes, and distribution costs.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

The investment products sold through LPL Financial are not insured deposits and are not FDIC/NCUA insured. These products are not Bank/Credit Union obligations and are not endorsed, recommended or guaranteed by any Bank/Credit Union or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible.

For Public Use — Tracking #1-719026 (Exp. 04/19)