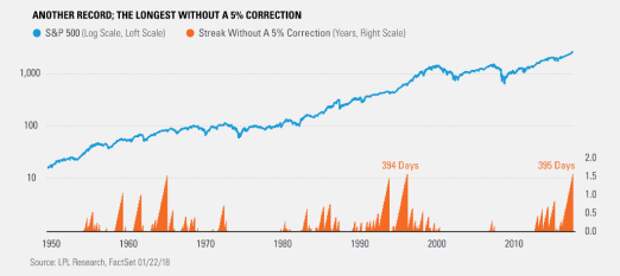

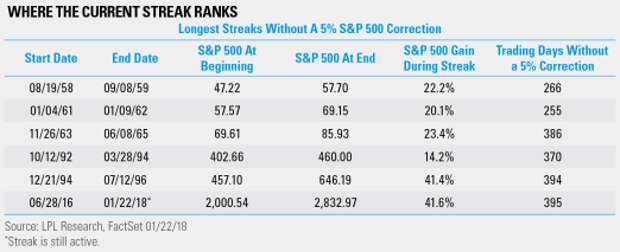

Incredibly, the S&P 500 Index has now gone a record 395 trading days in a row closing within 5% of its all-time high—just topping the 394 days seen during the mid-1990s. This is huge news! Other than a Brexit- induced single day sell-off in late June 2016, 466 of the past 467 trading days have closed within 5% of the all-time high.

Per Ryan Detrick, Senior Market Strategist, “This is a long time without a correction, but remember that the S&P 500 went on to gain for another four years, and more than double after that mid-1990s streak ended. It was no doubt a rocky ride, but it was also far from the end of that bull market. In other words, once this incredible streak ends, don’t expect the bull to end with it; as he could have a few more tricks up his sleeve.”

We see a similar path playing out with more volatility likely in 2018; but with the economy as strong as it is, we don’t see an end to this global bull market anytime soon either.

Last, here’s what this streak looks like compared to others; quite interesting that the S&P 500 has gained just over 40% during the streak, similar to the mid-1990s.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

Past performance is no guarantee of future results.

The economic forecasts set forth in the presentation may not develop as predicted.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses and cannot be invested into directly.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor

For Client Use — Tracking #1-690940 (Exp. 01/19)