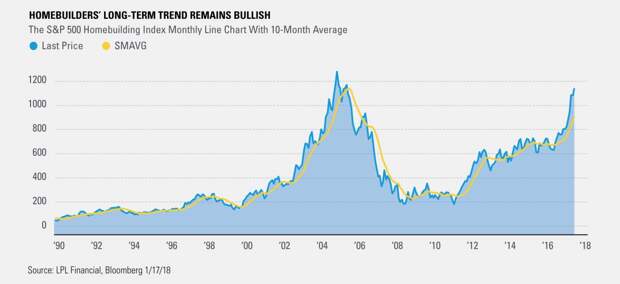

The National Association of Homebuilders (NAHB) Market Index dropped to 72 in January—down 2 points after reaching a high in December not seen in almost two decades. But will homebuilder stocks benefit? Let’s take a technical look at the S&P 500 Homebuilding Index, which is a gauge for the industry’s growth.

As the yellow line in the chart below indicates, the most recent month-end price for the index remains above its 10-month moving average. A rule of thumb is that if the price is above its moving average, the trend is likely to be upward sloping or bullish, which suggests the long-term bullish trend that began in January 2011 remains intact.SMAVG = Simple Moving Average

Homebuilder Sentiment

One metric used to determine bullish sentiment towards homebuilders, which influences price movement, is when the level of the NAHB Housing Market Index is greater than 50. (According to Bloomberg, a reading above 50 indicates more builders view conditions as good than poor.) This poses the question: Is January’s bullish sentiment reading telling of strong momentum and continued growth for the industry? Or, is it an extreme contrarian condition which increases the likelihood for a trend reversal?

Looking at historical data going back to 1990, the NAHB Housing Market Index has closed at or above 70 only 9.2% of the time (31 out of 337 months). Though infrequent, the average and median subsequent returns for the homebuilding index in these instances are higher over a six, nine, and twelve-month time horizon (see table below).

With builder sentiment at its current level, we cannot dismiss the possibility that the homebuilding index may be overextended and subject to a consolidation or even a trend reversal; however, based on the historical statistics, sentiment readings above 70 have been followed by continued strength over the following six, nine and twelve-months more than two-thirds of the time, which increases the likelihood that homebuilder equities sustain their longer-term bullish trend.

We will continue to monitor the housing data over the next few months as we enter into the spring season in order to better assess whether homebuilders may to continue to move higher.

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

The economic forecasts set forth in the presentation may not develop as predicted.

Because of their narrow focus, specialty sector investing, such as healthcare, financials, or energy, will be subject to greater volatility than investing more broadly across many sectors and companies.

Housing Market Survey: This concept tracks sentiment among participants in the housing industry. Source: National Association of Home Builders. Start date: Jan, 1985; Frequency: Monthly.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor Member FINRA/SIPC

For Client Use – Tracking # 1-689779 (Exp. 01/19)