Retirement. It's something nearly everyone thinks about at some point. And the closer you get to retirement age, the more you'll think about it.

One of the most important things to decide about retirement is when to do it. Considering delaying when you file for Social Security benefits? Here's how long it could take you to break even.

Image source: Getty Images.

When can you retire?

Practically speaking, you can retire at any age assuming you have sufficient money to cover your expenses. However, if you're counting on Social Security to help fund your retirement, there are some restrictions.

For anyone born between 1943 and 1954, the full retirement age (when you can receive full Social Security benefits) is 66. This full retirement age increases gradually for anyone born between 1955 and 1960 until it hits 67. If you were born in 1960 or afterward, your full retirement age is 67.

But you can file for Social Security retirement benefits sooner. The earliest age at which you can file for Social Security benefits is 62. However, the catch is that you'll be penalized and receive lower benefits based on how much earlier than your full retirement age you file for benefits.

You can also opt to retire after your full retirement age. Doing so will increase your Social Security benefits — at least up to a point. There won't be any added benefits once you reach age 70.

Breakeven points

Let's assume your full retirement age is 67 and that your monthly benefit at that age is $1,000. Let's also assume that you want to file for Social Security benefits at the earliest age possible — 62.

Your monthly benefit for retiring at age 62 would be reduced by 30% to $700. The following chart shows hypothetical cumulative Social Security benefits that compare the retirement ages of 62, 65, 67, and 70.

Data source: Social Security Administration. Chart created by author.

As the chart above shows, it would take quite a while for the additional money you'd receive for delaying Social Security benefits to break even with what you'd get by retiring early at age 62. Waiting until age 65 to file for benefits would result in breaking even when you're around 72 and a half. Waiting until your full retirement age of 67 would mean that you'd break even when you're a little over 78 and a half. Pushing back to collect benefits at age 70 would result in a breakeven point at a little under age 80 and a half.

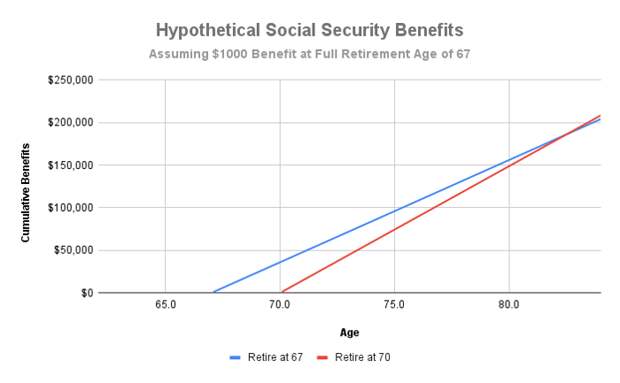

What if you plan to retire at your full retirement age of 67 but are considering holding off to file for Social Security until age 70? The breakeven point for you would be at age 82 and a half.

Data source: Social Security Administration. Chart created by author.

Those breakeven points might seem daunting. Keep in mind, though, that the longer you live, the more delaying Social Security benefits will pay off.

A lot to consider

There's a lot to consider in deciding when to file for Social Security benefits. You'll obviously want to factor in your health and family longevity history. Your other sources of retirement income and personal retirement goals are also important to think about.

Some individuals might have enough additional income that they can retire without needing Social Security benefits. Your breakeven point could be lower if you filed for benefits and invested the money. Of course, it's also possible that your investments perform poorly and increase your breakeven point.

If you're married, don't forget to consider your spouse's Social Security benefits. Your spouse's benefits could be reduced by you filing early.

Your situation will probably be different than your friends and extended family. It's important to make the right Social Security decision for you.

The $21,756 Social Security bonus most retirees completely overlook

If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $21,756 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we're all after. Simply click here to discover how to learn more about these strategies.

The Motley Fool has a disclosure policy.

The post Delaying Social Security? Here’s How Long It Could Take You to Break Even. appeared first on Retirely.