In February, more than 52 million retired-worker beneficiaries took home an average Social Security check of $1,980.86. This might not sound like a game-changing amount of money, but it plays a critical role in helping retirees make ends meet.

According to the Center on Budget and Policy Priorities, 22 million people were pulled above the federal poverty line in 2023 because of Social Security payouts, including 16.3 million adults aged 65 and over. If Social Security didn’t exist, the poverty rate for seniors would be almost four times higher than it was in 2023 — 10.

1% with Social Security versus an estimated 37.3% if the program didn’t exist.Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Despite the importance of Social Security income to most retirees, the foundation of this vital program is crumbling. Strengthening it will require action on the part of our elected officials, which includes President Donald Trump.

However, the president is focused on meaningfully reducing federal expenditures during his second term, which raises the question: Is President Trump coming for your Social Security check?

President Trump delivering his State of the Union address to Congress. Image source: Official White House Photo.

Social Security benefit cuts are an estimated eight years away

Before directly addressing the question at hand, it’s important to understand the challenges and shortfalls America’s leading retirement program is facing.

For the last 85 years (i.e., since the first retired-worker check was mailed), the Social Security Board of Trustees has released an annual report detailing the current financial health of the program. This includes tracking every dollar in income, as well as noting where those dollars are spent.

What’s even more important with this annual report is the long-term (75-year) outlook for Social Security, which takes into account a host of dynamic factors, such as fiscal and monetary policy, along with demographic shifts. A number of ongoing demographic changes, such as rising income inequality, a significant reduction in legal net migration into the U.S., and a historically low birth rate, are primarily responsible for the program’s worsening financial health.

For 40 consecutive years, the Trustees Report has been pointing to a long-term funding obligation shortfall. In plain English, projected spending in the 75 years following the release of a report will outpace income collected. In 2024, this long-term funding deficit grew to $23.2 trillion.

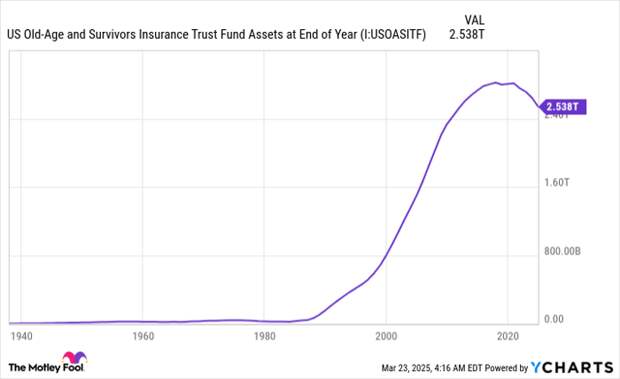

The other (and more immediate) issue is the forecast depletion of the Old-Age and Survivors Insurance Trust Fund’s (OASI) asset reserves by 2033. If this excess cash built up since inception is exhausted in eight years, retired workers and survivor beneficiaries could see their monthly Social Security checks slashed by up to 21%.

Take note that a potential exhaustion of the OASI’s asset reserves doesn’t mean Social Security is bankrupt, insolvent, or in any way going to stop payouts. Rather, it signifies the existing payout schedule, inclusive of cost-of-living adjustments (COLA), isn’t sustainable. If you’ve earned a retired-worker benefit, you’ll receive one. What’s in question is whether you’ll receive 100% of what you’re due after 2033.

The OASI’s asset reserves are projected to be gone by 2033. US Old-Age and Survivors Insurance Trust Fund Assets at End of Year data by YCharts.

Is President Trump coming for your Social Security check?

With a better understanding of what ails Social Security, let’s turn back to the all-important question: Is President Donald Trump coming for your Social Security check?

The blunt answer is no, for two very good reasons.

The first is that Trump has pledged to not touch Social Security. Prior to being elected president, he vowed to leave the program alone — i.e., he wouldn’t make any proposals that call for sweeping benefit cuts, such as gradually raising the full retirement age. Raising the full retirement age, which is the age where workers are eligible to receive 100% of their retirement benefit, is a popular proposal among GOP lawmakers that works to reduce Social Security’s outlays over the long run.

Secondly, amending the Social Security Act can’t be done without bipartisan cooperation on Capitol Hill, which is something that’s become increasingly scarce. Hypothetically, even if the president had suggested that sweeping reforms be made to Social Security, 60 votes in favor would be required in the Senate to amend the law. Neither party has held a supermajority of 60 seats in the upper house of Congress since 1979.

Furthermore, Democrats in the Senate have previously suggested they won’t vote in favor of any proposal that reduces Social Security benefits. Without bipartisan cooperation, sweeping changes that would notably alter Social Security checks can’t be made.

While there may be some public concern about the Department of Government Efficiency (DOGE) initiative looking for ways to cut Social Security’s expenditures, there’s no threat of DOGE or President Trump coming for your Social Security check.

Image source: Getty Images.

Efficiency-based cost-cutting is on the table

The one caveat to the above discussion is that Donald Trump has left the door open for efficiency-based cuts to strengthen Social Security. In a roundabout way, he’s breaking his campaign promise not to touch Social Security.

In a December interview with Meet the Press, Trump stated, “I said to people we’re not touching Social Security, other than we make it more efficient.”

Efficiency-focused cost-cutting has nothing to do with directly slashing benefit checks. Rather, proposed changes would be primarily focused on structural or procedural aspects of the program.

In each of the previous four years Trump’s was president, he provided a budget proposal. All four of these budgets called for Social Security cuts that ranged from a cumulative low of $24 billion to an aggregate high of $72 billion over a 10-year period.

For example, Trump’s budget proposals frequently called for retroactive benefits for workers with disabilities to be shortened to six months from the current 12 months. Making this adjustment accounted for a sizable percentage of the estimated 10-year cost-savings in the president’s budget proposals.

Additionally, an executive order (EO) from President Trump on Feb. 11 (Implementing The President’s “Department of Government Efficiency” Workforce Optimization Initiative) guided federal agencies to reduce their respective workforce and cut costs. This EO is forcing the Social Security Administration to trim its staff by 7,000 workers and shutter some of its physical locations.

While these initiatives have the potential to reduce spending by billions of dollars, it’s ultimately just a drop in the bucket when staring down a $23.2 trillion (and growing) long-term funding shortfall.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” »

The Motley Fool has a disclosure policy.

The post Is President Donald Trump Coming for Your Social Security Check? appeared first on Retirely.