We dedicated a lot of real estate in our 2018 Midyear Outlook publication to the idea that the business cycle may still have legs, considering indicators such as the ISM Manufacturing Index, the Leading Economic Index, and the yield curve. The strong growth in corporate profits also points to further economic growth ahead: The U.

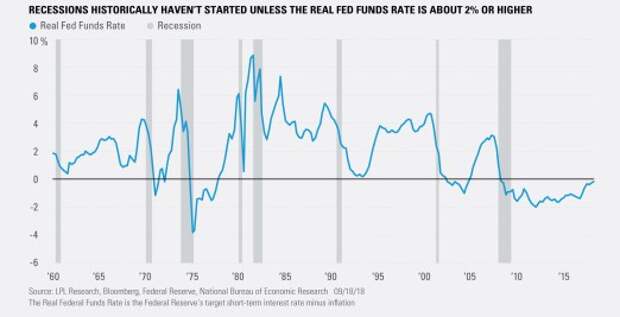

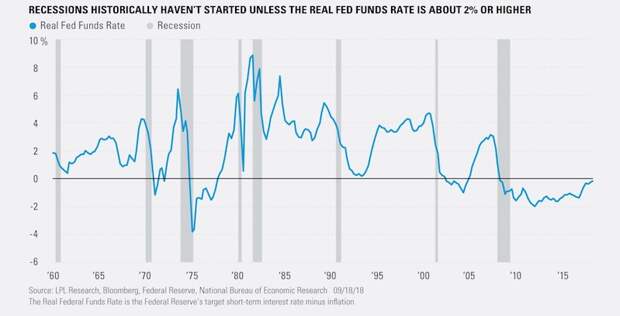

S. economy has never been in recession when corporate profits were growing.We can also look at the real federal funds rate (the Federal Reserve’s target short-term interest rate minus inflation) as an indicator of whether we are late in the cycle. As shown in the LPL Chart of the Day, the current real fed funds rate is right around zero (2% inflation and ~2% fed funds rate).

For inflation, we use the annual change in the personal consumption expenditures index excluding food and energy (core PCE).

“The near zero level of the fed funds rate, on a real basis adjusted for inflation, suggests the Federal Reserve is not close to over-tightening,” noted LPL Chief Investment Strategist John Lynch. “That is a good sign for continued economic growth.” As the chart also shows, the real fed funds rate was 1.9% or higher ahead of each of the past eight recessions back to 1960.

The Federal Reserve will almost certainly hike rates next week. Market odds favor another hike in December though that is less certain. But it would likely take a string of at least a half dozen more hikes to put the real fed funds rate in the range that has historically preceded recessions. Given benign recent inflation data, including smaller-than-expected increases in producer and consumer prices and soft import and export price data, and contained inflation expectations, we anticipate interest rate stability.

That points to a business cycle that may still have a fair amount of room to run.IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

The investment products sold through LPL Financial are not insured deposits and are not FDIC/NCUA insured. These products are not Bank/Credit Union obligations and are not endorsed, recommended or guaranteed by any Bank/Credit Union or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible.

For Public Use — Tracking # 1- 772903 (Exp. 05/19)