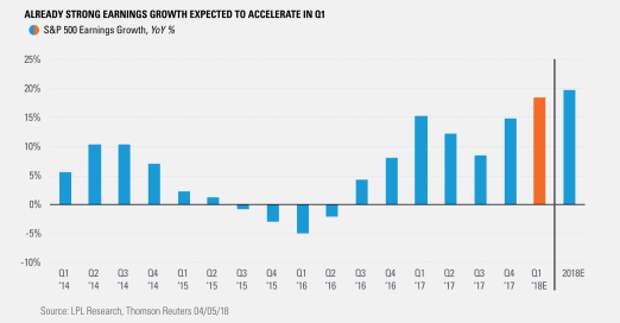

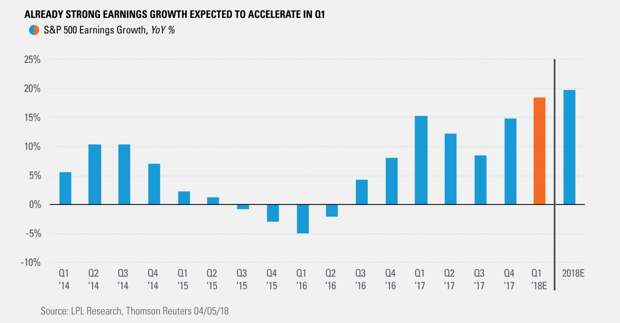

First quarter earnings season kicks off this week with several financial companies reporting results on April 12–13, and we are expecting another strong quarter of results. The S&P 500 Index has grown earnings at a double-digit clip three out of the past four quarters (as shown in today’s Chart of the Day below); could it make it four out of five?

LPL Chief Investment Strategist John Lynch noted, “Earnings should get a boost from the new tax law, on top of strong economic growth globally, robust U.S. manufacturing activity, and a weaker U.S. dollar. Gains are expected to be broad-based, with potential increases in all 11 S&P sectors.” Some key areas to watch include company announcements on planned uses of tax law proceeds, the impact of trade tensions on company outlooks, and potential wage pressures. In our latest Weekly Market Commentary, due out later today, we provide a detailed preview of the upcoming earnings season.

Though difficult to predict, robust growth in corporate profits may help stocks stabilize by shifting investor attention away from trade headlines and toward strong company fundamentals. Looking ahead, we maintain our 2018 S&P 500 earnings forecast of $152.50*, representing growth in the mid-teens. That strong earnings growth forecast supports our double-digit return expectation for the index in 2018, though those gains may come with some volatility.

*Based on our revised forecast from Outlook: 2018

IMPORTANT DISCLOSURES

The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

The investment products sold through LPL Financial are not insured deposits and are not FDIC/NCUA insured. These products are not Bank/Credit Union obligations and are not endorsed, recommended or guaranteed by any Bank/Credit Union or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible.

For Public Use — Tracking #1-717907 (Exp. 04/19)